A South Dakota-based company wanted to replicate critical data and systems to ensure that they were not at risk for downtime and permanent data loss. Read the full story to find out how the company now benefits from Disaster Recovery as a Service, with tested failover and run.

The Challenge

The Challenge

Since 1941, Black Hills Federal Credit Union has served as a trusted financial partner for its members, helping them improve their financial well-being through personal, business, and agriculture banking. Over the years they have grown and added loans, savings, investment services, insurance, credit cards and protection products, servicing more than 80,000 members at 15 member service centers across South Dakota.

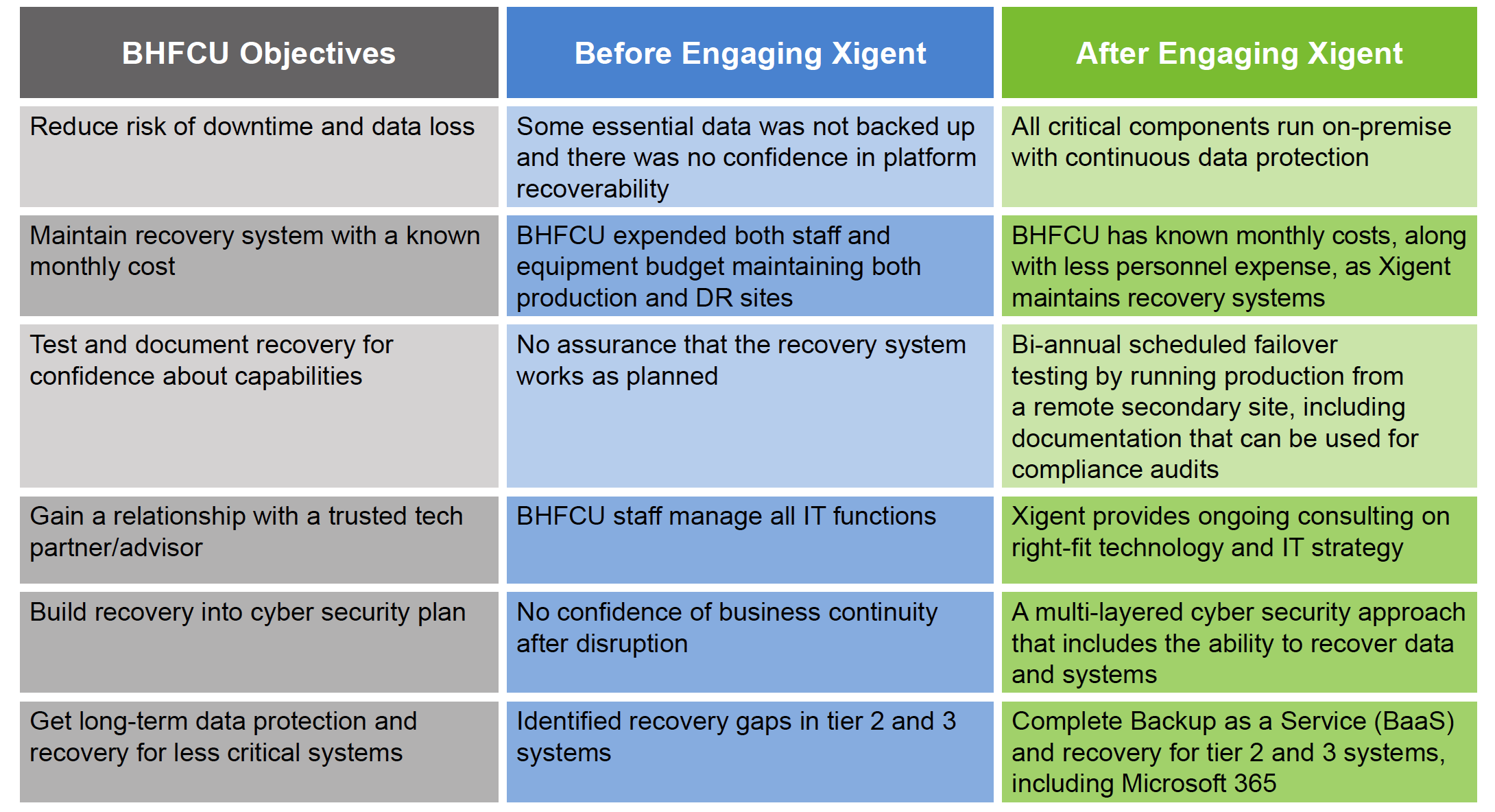

When John Buxton, Senior VP/CIO, Information Security Officer, took over IT for the credit union in 2014, he discovered some gaps in their self-managed backup and recovery systems. Some critical data and applications were not being replicated and testing limitations reduced his confidence in their ability to recover.

“We determined pretty quickly that we just didn’t have the flexibility or the ability to fully recover in the way that we wanted.” – John Buxton, Senior VP/CIO

He sought out a technology partner that could help them meet their objectives: a system that would fully replicate their data and applications, and regular testing and demonstration of their ability to recover all critical systems.

This was no easy task as BHFCU has a complex IT infrastructure integrated with several third-party systems. The credit union’s recovery infrastructure had to connect virtualized systems, along with unix-based infrastructure to both their production and disaster recovery site and offer uninterrupted service to members and staff. “We were trying to do it ourselves, but this was really, really difficult. It’s one thing to set it up and kind of believe that you can do it, but it is much more difficult to really test and document the process,” said Buxton.

BHFCU met with a variety of vendors but found few with the expertise or capabilities that they were looking for. Buxton said he wanted to find a managed services provider who could be a good long-term partner who really understood their business objectives. “With everything we do, the question is always ‘how is this going to improve service to members?’ It’s talked about in almost every meeting.”

Xigent met with BHFCU to review its business impact analysis and put together a plan that addressed the credit union’s IT needs, fully understanding their unwavering commitment to customer service for members. The plan based on current facts and findings from the analysis included leveraging Xigent’s Disaster Recovery as a Service and Backup as a Service, and extending their data center network.

The credit union and Xigent worked together to improve and evolve the system for future needs, adding failover and run capabilities. While this level of recovery was above and beyond what industry regulators currently required, the credit union wanted to stay ahead of future mandates. To offer the company the ability to verify and document that all of their critical data was fully recoverable, Xigent implemented a capability for BHFCU to test their systems by failing over from their production to their recovery site hundreds of miles away.

Every year the entire company tests the recovery by running all critical systems from the disaster recovery infrastructure. It is a seamless experience for staff and credit union members. Buxton said they are able to verify that their data is there, and that few people outside IT even realize that anything has changed. “When we do testing and we do failover, it’s not just a failover to say, ‘Yep, it works. It’s over there.’ We run like we would on our production site at our recovery location and it’s so good that nobody notices.”

Buxton says it is hard to compare their former disaster recovery efforts with today’s system, as the Xigent managed plan delivers so much more. BHFCU has gone from not even having a plan to back up critical systems, to having every mission critical function and database continuously replicated at a second site. And most importantly, it is proven through testing every year.

“There’s a trust level. It’s not about [Xigent] trying to sell you something; it’s about them understanding your business and seeing a way to address any gaps.” – John Buxton, Senior VP/CIO

If the BHFCU IT team had to duplicate everything that Xigent does for them, it would take a considerable amount of time and would not be done as efficiently, Buxton said. “We probably wouldn’t have the same expertise level that Xigent has which would lead to even more work and more employees needed to try to do the work. Our partnership with them allows us to concentrate on member-service related tasks.”

The scheduled failover testing makes it easy for the credit union to maintain compliance, prepare for audits, and meet governance requirements. “We can easily provide the documentation and the details required for compliance purposes. It’s all right there,” Buxton said.

Today, BHFCU leadership know that even in an emergency, they will not lose essential data. Their members do not know what goes on behind the scenes, but they notice that the credit union always meets their needs.

“Our members’ trust in us is our top priority. If there are issues in the local area and other systems are down, we’re not. It’s a confidence level they have with us. “ – John Buxton, Senior VP/CIO

The credit union has moved from a situation where critical data and systems are not properly backed up, to having a well-managed recovery system that BHFCU IT staff fully understand. Buxton says his team has confidence that in the worst-case scenario, BHFCU will have the flexibility to recover everything they need to serve their members.

“With IT, you’re constantly evolving, and I don’t know that you ever say that you’re done, but we’re in a really, really good spot. When you’ve got a great partner like Xigent, that makes it easier,” Buxton says.

Call 800-298-9543 to connect with an IT expert at Xigent today! To understand the business case for Black Hills Federal Credit Union, confirm your email so we can discuss it with you.

Download Case Study